how to calculate income tax malaysia

Come and visit our site already thousands of classified ads await you. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

First of all you need an Internet banking account with the FPX participating bank.

. How To Pay Your Income Tax In Malaysia. This section only applies if you want to calculate your income tax manually. The CRA needs your identification and other information to assess your tax return and calculate your goods and services taxharmonized sales tax GSTHST credit plus any benefits you may be entitled to under the Canada child benefit CCB.

This kind of demand raised on the person is known as Tax on Regular Assessment. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. All classifieds - Veux-Veux-Pas free classified ads Website.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Enter the date that you became a resident of Canada for income tax purposes. How to calculate annual income.

Situations covered assuming no added tax complexity. Here are the many ways you can pay for your personal income tax in Malaysia. Guide To Using LHDN e-Filing To File Your Income Tax.

The easiest income tax calculator in Malaysia to use plus income tax guides to answer any income tax question you may have. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

If you have many products or ads. If your income is less than 5000RMB per month then you pay no tax. The participating banks are as follows.

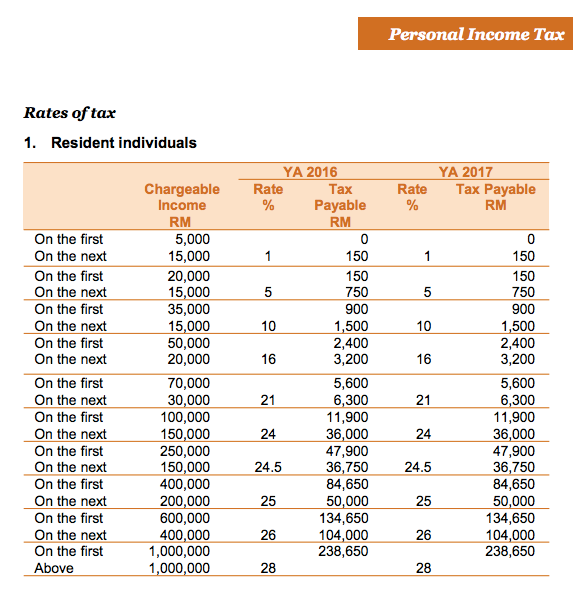

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Recall employees status and information. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

How to calculate taxes taken out of a paycheck. Only certain taxpayers are eligible. Our Income Tax Calculator for Individuals works out your personal tax bill and marginal tax rates no matter where you reside in Canada.

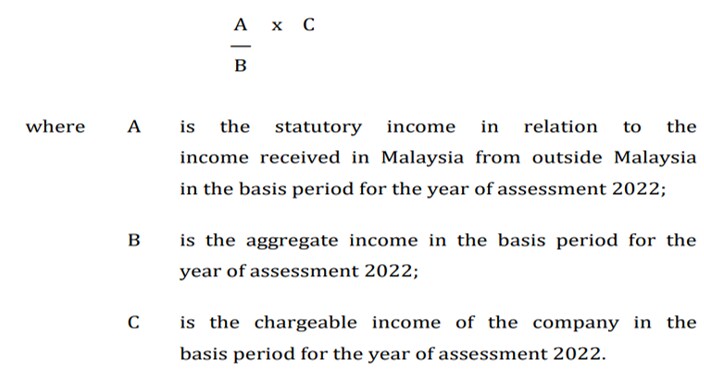

All partners can be charged a. This is based on the number of days spent in Malaysia and should not. Tax payable Income- Tax Allowance x tax percentage quick deduction.

Tax Offences And Penalties In Malaysia. Estimate your penalty for Self Assessment tax returns more than 3 months late and late payments. 1 Pay income tax via FPX Services.

Income tax is a tax imposed by the government on the income earned by individuals and businesses. Individuals who own a property in Malaysia that isnt used for business purposes and receive a rental income are subject to income tax. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

The first 5000RMB of the income of foreigners is tax-free given as tax allowance. You can appeal against a penalty if you have a reasonable excuse. The Gini coefficient measures the inequality among values.

The system is thus based on the taxpayers ability to pay. This is explained in greater detail under Section 4d of the same Act. In this regard to avail tax advantages to its fullest it is crucial to understand the existing income tax slab for the fiscal year.

10 Perkara Wajib Tahu Tentang Cukai Pendapatan LHDN 2 Knowing all the tax reliefs that you may be eligible for in 2022. What are you waiting for. So questions like how to calculate my income tax will not be stopping you from getting your income tax returns.

The general formula is. As per the Income-tax Act every person must calculate and pay their due taxes. Expenses That Can be Added to the Cost Base.

The surcharge is imposed as a percentage on all individual income taxes. The result is net income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

Title Costs such as the legal fees incurred when. If your income is more than 5000RMB and less than 8000RMB per month then you pay only a 3 tax. Including daily emissions and pollution data.

Income Tax SlabBrackets Applicable for FY 2019-20. In economics the Gini coefficient ˈ dʒ iː n i JEE-nee also known as the Gini index or Gini ratio is a measure of statistical dispersion intended to represent the income inequality or the wealth inequality within a nation or a social group. Its easy to use no lengthy sign-ups and 100 free.

One must file an income tax return to justify hisher income. Find all the latest news on the environment and climate change from the Telegraph. Incidental Costs such as your rental advertisement fees legal fees and stamp duty.

Ownership Costs such as those incurred when searching and inspecting for properties. Unlike the traditional income tax filing where you have to print out the income tax form and fill it in manually the e-Filing income tax form calculates your income tax for you automatically. To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax.

Surcharges on income tax. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. The Gini coefficient was developed by the statistician and sociologist Corrado Gini. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction.

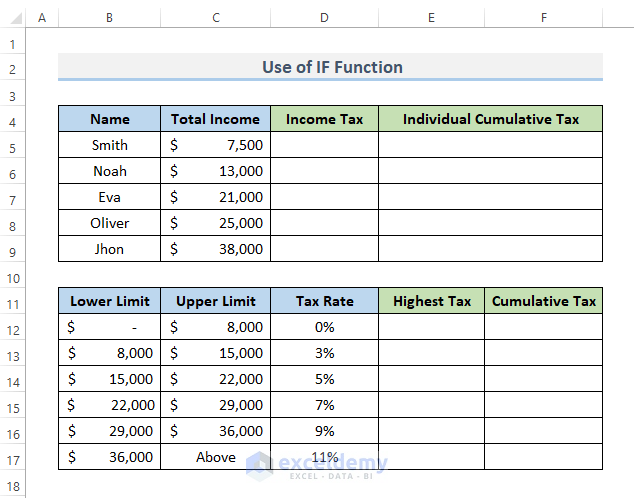

Simply click on the year and enter your taxable income. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. In this article we will go through the computerised method to calculate PCB accurately in four steps.

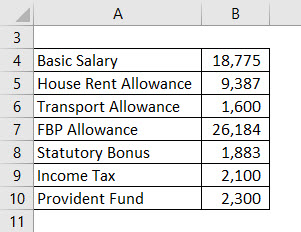

Firstly fill in the values for the following employee information. Hearst Television participates in various affiliate marketing programs which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites. The deadline for tax payment is the same as tax finalization meaning no later than 90 days from the end of the calendar year.

Members of officially recognised churches pay church tax as a surcharge on their income tax. The expenses that investors can add to a cost base include but are not limited to. Conversion of taxable income If the taxable income is received in a foreign currency it must be converted into Vietnamese dong at the average trading exchange rate on the inter-bank foreign currency market published by.

How Does Monthly Tax Deduction Work In Malaysia. When the Income Tax Department underestimates the income and the consecutive due tax it takes special measures to calculate the amount of tax that should be paid.

Computation Of Income Tax Format In Excel For Companies Exceldemy

Salary Formula Calculate Salary Calculator Excel Template

How To Do Pcb Calculator Through Payroll System Malaysia

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Cukai Pendapatan How To File Income Tax In Malaysia

Taxable Income Formula Examples How To Calculate Taxable Income

Could A Data Tax Replace The Corporate Income Tax

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

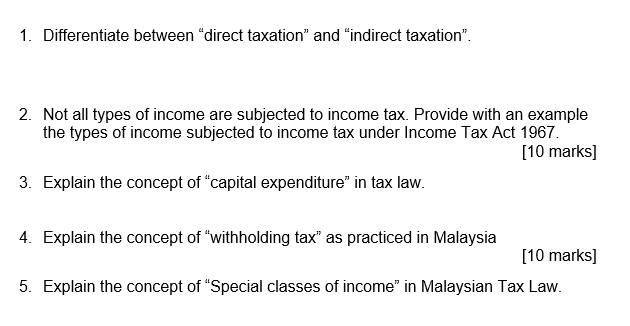

Solved 1 Differentiate Between Direct Taxation And Chegg Com

How To Calculate Income Tax In Excel

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

This Income Tax Calculator Shows What You Owe Lhdn Ringgit Oh Ringgit

How To Calculate Income Tax In Excel

How To Calculate Foreigner S Income Tax In China China Admissions

2022 Malaysian Income Tax Calculator From Imoney

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

0 Response to "how to calculate income tax malaysia"

Post a Comment